Solar Renewable Energy Certificates

Xpansiv® Managed Solutions™ streamlines the SREC management process—from certification and regulatory setup to ongoing monitoring, monetization, and payments—so solar owners can maximize the value of their SRECs with confidence.

About

1 SREC = 1MWh of Solar Electricity. SRECs are sold separately from the electricity.

Generation

A 10 kW facility generates around 12 SRECs annually

Value

Is determined by market supply and demand mechanics

Certification

Facilities must be certified by a state to sell SRECs.

Solar RECs at a Glance

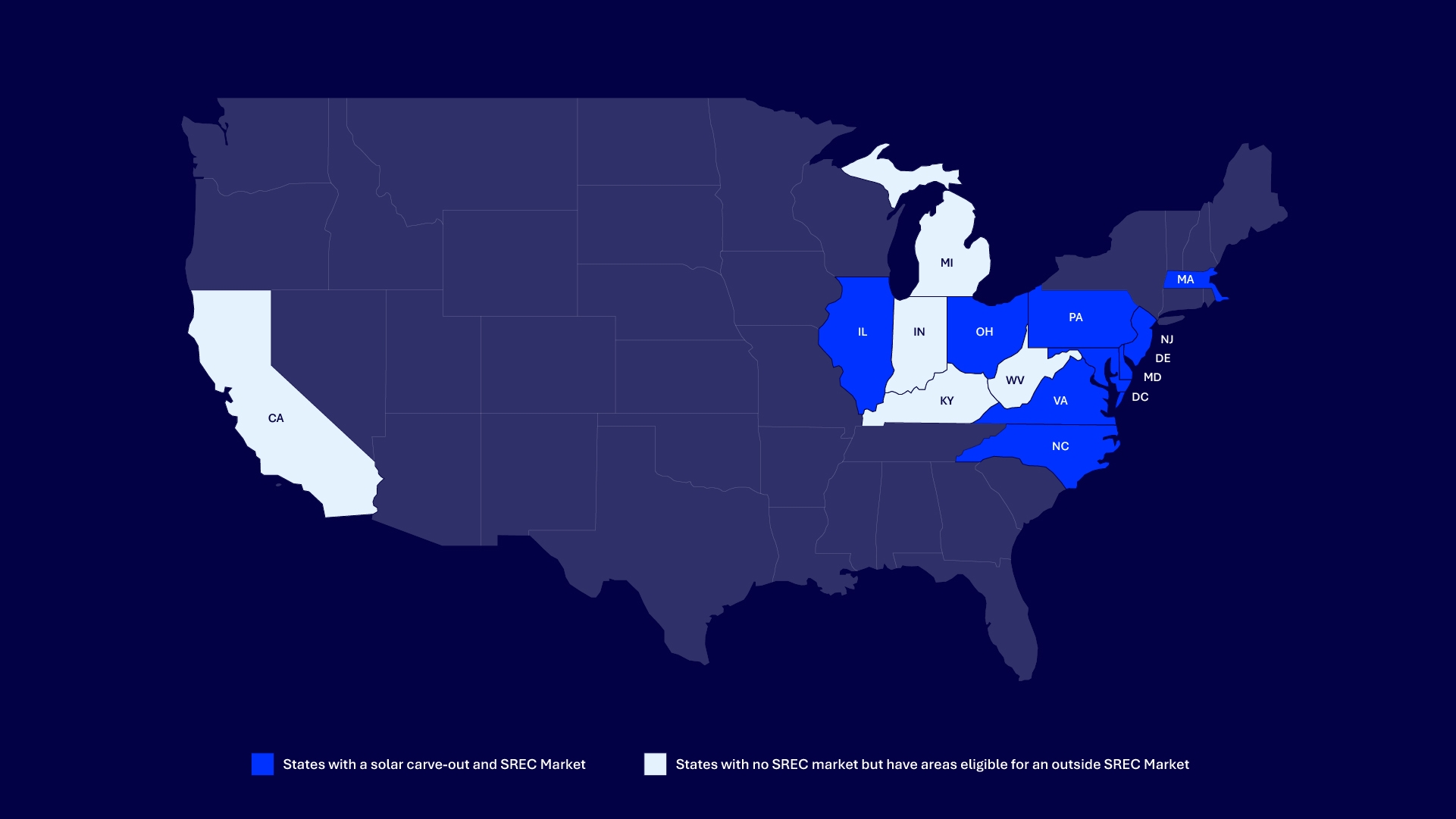

In many U.S. states, Renewable Portfolio Standards (RPS) require electricity suppliers to source a portion of their power from solar. Solar Renewable Energy Certificates (SRECs) provide the mechanism to track, verify, and monetize this clean energy production.

SREC values fluctuate based on market supply and demand. When SREC supply is limited and demand from electricity suppliers increases, prices can rise. Conversely, when supply is abundant, prices tend to decline. Many states include a Solar Alternative Compliance Payment (SACP), which sets an upper limit on pricing by defining the penalty for non-compliance.

Get Started with Xpansiv Managed Solutions™

3. Understand Your Timeline

Once your system is certified, your first SRECs typically appear within two months (or up to six months in Massachusetts, depending on state processes).

New Jersey

New Jersey’s SREC market is the largest in the nation. In July 2012, the state passed legislation to pull forward the RPS requirements from the 2014 energy year to account for the substantial amount of solar capacity installed in the state. In May 2018, the state increased the RPS requirements again.

For a period of time before January 2011, NJ systems were eligible to apply to the DC SREC market; today, NJ-sited systems are only eligible for participation in the NJ SREC market.

The NJ Office of Clean Energy issues clients a state certification after the system is officially interconnected with the utility. Once the state certification is provided, clients may complete their SRECTrade.com application, and SRECTrade can complete the registration of the facility in the PJM-GATS tracking registry. NJ is the only SREC state in which the client and/or installation company is responsible for obtaining the state SREC certification. In other states, SRECTrade can complete the certification process for its clients

Details for NJ Systems

Markets for NJ Systems: NJ and PA Tier-I

Tracking Registry: GATS

Energy Year: June – May

Eligible System Locations: NJ

Massachusetts

The Massachusetts Department of Energy Resources (DOER) launched the first Massachusetts SREC program in January 2010. The program, now referred to as SREC-I, was created as a Massachusetts-specific solar carve-out of the New England REC market. SREC-I was originally established with a capacity limit of 400 MW, but this was reached in the spring of 2013. Pursuant to Emergency Regulations and revisions to the RPS Class I Regulation, the DOER continued to qualify projects under SREC-I through the first half of 2014, after the initial 400 MW limit was reached. On April 25, 2014, the DOER launched its SREC-II program to carry Massachusetts to its goal of installing 1,600 MW of solar capacity by 2020. The SREC-II program came to a close in November 2018 as the program surpassed its original goal of 1,600 MW prior to 2020.

In November 2018, the Solar Massachusetts Renewable Target Program was launched. More information on this incentive program can be found here.

Details for MA Systems

Markets for MA Systems: MA

Tracking Registry:

NEPOOL-GIS

Energy Year: Jan – DEC

Production

Tracking: PTS

Pennsylvania

A variety of federal and state incentives, including SRECs, led to a substantial build-out of solar in the state. And until 2017, Pennsylvania allowed systems located outside of the state to register for and participate in the PA SREC market, further impacting supply. However, in 2017, Pennsylvania passed Act No. 40, which restricted geographical eligibility for the PA SREC market to Pennsylvania-sited solar photovoltaic systems effective October 30, 2017. The law may also impact out-of-state systems which were certified prior to the rule change. The Pennsylvania Public Utilities Commission will be reviewing the Act and issuing an Order regarding eligibility in the program in the coming months.

For a period of time before January 2011, PA-sited systems were eligible to apply to the DC SREC market; today, PA-sited systems are only eligible for PA and OH.

Details for PA Systems

Markets for PA Systems: PA and OH

Tracking

Registry: GATS

Energy Year: June – May

Eligible System Locations: PA

Maryland

A proactive state legislature and aggressive SREC requirements kept this market relatively stable between its inception in 2008 and early 2015. However, beginning in 2015, the Maryland SREC market started to become oversupplied due to a substantial amount of solar capacity being installed in the state. In early 2017, the Maryland General Assembly overrode Governor Hogan’s veto of the 2016 Clean Energy Jobs Bill, which provides for a slight increase in the state RPS beginning in 2017.

In 2024, the Maryland Senate passed The Brighter Tomorrow Act. This legislation aimed to address lower than expected build rates in the state in hopes of increasing SREC market supply. The Brighter Tomorrow Act was introduced and passed in an effort to jumpstart the market. The act creates a 1.5x price multiplier for systems that meet certification requirements, including a generating capacity of 5 MW or less, be placed in service between July 1, 2024 – January 1, 2028, and be located on a rooftop, parking canopy, or a brownfield site within Maryland.

Only Maryland-sited facilities may register for the Maryland SREC program. Certain Maryland-sited solar water heating systems are also eligible to produce SRECs.

Details for MD Systems

Markets for MA Systems: MD, MD Brighter Tomorrow (BT) and PA Tier-I

Tracking

Registry: GATS

Energy

Year: Jan – Dec

Eligible System Locations: MD

District of Columbia

A combination of aggressive solar goals, a restrictive infrastructure for development, and the District’s demographics has preserved the DC SREC market, where SREC prices remain high due to undersupply. The D.C. City Council passed a law in July 2011 preventing out-of-state systems registered after January 31, 2011 from participating in the DC SREC Market, further limiting supply.

Recently, efforts to promote greater access to solar, such as a 2013 community net metering law, initiatives to promote greater penetration of solar installations among low-income residents, and the 2015 RPS Expansion Act promise to increase solar installation build rates across the District.

Market Details for DC Systems

Markets for DC Systems: DC and PA Tier-I

Tracking Registry: GATS

Energy Year: Jan – Dec

Eligible System Locations:DC

Ohio

The Ohio SREC market is oversupplied, much like its neighboring state of Pennsylvania. Under current market conditions, a substantial number of systems sited in PA and other bordering states look to OH to sell SRECs. This is especially true for systems located in states that do not have their own SREC market. However, since Ohio froze its RPS in 2014, the market has struggled with oversupply and an uncertain future.

For a period of time before January 2011, OH systems were eligible to apply to the DC SREC market. Today, OH-sited systems are only eligible to sell into OH. However, several bordering states are eligible for the OH market.

Prior to the 2014 freeze, OH-sited SRECs sold at a premium to SRECs from facilities in bordering states, due to an in-state/out-of-state distinction that was removed as part of the freeze. SRECTrade will be tracking Ohio as it decides what to do as the expiration of the freeze approaches.

Market Details for OH

Markets for OH systems: OH and PA Tier-I

Tracking Registry: GATS or MRETS

Energy Year: Jan – Dec

Eligible System Locations: OH, PA, MI, IN, KY, WV

Delaware

In 2011, the Delaware legislature amended the solar portion of the state Renewable Portfolio Standard (RPS) to switch the burden of acquiring SRECs away from the state power providers to the electric distribution companies. This amendment drastically reduced the number of buyer-participants, effectively making Delmarva Power, the largest electric distribution utility in Delaware, the de-facto long-term buyer for the majority of the DE SREC requirement. In response, Delmarva Power proposed the implementation of an SREC procurement program, called SRECDelaware, which provides 20-year contracts to SREC sellers on a competitive basis. A pilot version of the program was conducted in the spring of 2012, and a revised solicitation was conducted in the spring of 2013. Delmarva plans to host at least one solicitation each spring in order to fulfill its long-term SREC needs. More information about the Procurement can be found on the SRECDelaware site.

Markets for DE Systems

Markets for DE Systems: DE and PA Tier-I

Tracking Registry: GATS

Energy Year: June – May

Eligible System Locations: DE

North Carolina

North Carolina accepts SREC registrations from facilities sited in all 50 states. This national acceptance of SREC registrations virtually guarantees that the local SREC program will be oversupplied as long as the market exists.

For a period of time before January 2011, NC systems were eligible to apply to the DC SREC market.

Markets for NC Systems

Markets for NC Systems: NC and PA Tier-I

Tracking Registry: NC-RETS or GATS

Energy Year: Jan – Dec

Eligible System Locations: All 50 States

California

In March 2010, the California Public Utilities Commission (CPUC) approved the use of tradable renewable energy credits (TRECs) in the California Renewable Portfolio Standard (RPS) program. This framework allows parties required to meet the RPS to purchase RECs “unbundled” or separate from the associated renewable energy. At the time, the announcement stated that the initial use of TRECs for RPS compliance would be limited to no more than 25% of a given investor owned utility’s (IOU) or Electric Service Provider’s (ESP) annual obligation. The initial price cap was set at $50. Both the 25% limitation and $50 price cap were to be lifted as of 12/31/13.

In April 2011, SBX1-2 was signed into place, which capped the use of TRECs at 25% for the compliance period ending December 31, 2013, which will further decrease to 10% of the utility’s RPS requirement by 2017.

In 2015, California extended the timeline and expanded the requirements of its RPS. The RPS now reaches to 2030, when 50% of each utility’s retail sales must come from renewable energy. More information about SB 350 is available here.

California’s REC market is tracked by the Western Renewable Energy Generation Information System (WREGIS), which tracks renewable energy generation and creates WREGIS certificates for every REC generated. The WREGIS certificates (or RECs) are used to demonstrate compliance with state RPS policies. WREGIS serves 14 states and two Canadian provinces.

Markets for CA Systems

Eligible SREC Market: None

Tracking Registry: WREGIS

Illinois

The Illinois Power Agency (IPA) and the Illinois Commerce Commission (ICC) are in the process of implementing the Long-Term Renewable Resources Procurement Plan (LTRRPP). Under the LTRRPP, the state will hold procurements for utility-scale wind and solar and will secure distributed generation and community solar REC contracts through the LTRRPP Adjustable Block Program (ABP).

The ABP features capacity-based blocks set at predetermined prices for 15-year REC contracts. The program is open to new distributed generation solar and community solar projects meeting the ABP’s eligibility parameters. “New” means “energized on or after June 1, 2017” as defined in the Plan as filed with the ICC for approval. There are two types of “new” projects that are eligible for the ABP: (1) Photovoltaic distributed renewable energy generation devices (i.e., DG solar); and (2) Photovoltaic community renewable generation projects (i.e., community solar). DG solar must be interconnected, behind-the-meter, and less than or equal to 2,000 kW AC.

The ICC is expected to issue its Order on the Implementation of the LTRRPP on or before April 3, 2018. For more information and updates regarding the state’s past and future procurements and the upcoming ABP, please visit our blog or the IPA website.

Markets for IL Systems

Markets for IL Systems: IL and PA Tier-I

Tracking Registry: GATS or MRETS

Virginia

On April 12, 2020, Governor Ralph Northam signed the Virginia Clean Economy Act (VCEA), establishing a mandatory Renewable Portfolio Standard (RPS) in Dominion and Appalachian Power Company (APCo) service territories. A primary component of the VCEA is that 1% of Dominion’s RPS compliance obligation must come from in-state distributed generation solar resources (DG) smaller than 1 MW in nameplate capacity. This requirement will represent approximately 90 MW in 2021 and increase to approximately 250 MW by 2030, thus supporting the development of about 160 MW of DG solar over the next nine years.

Markets for VA Systems

Markets for VA systems: VA and PA Tier-I

Tracking Registry: GATS

Energy Year: Jan – Dec

Eligible System Locations: VA

SREC Markets

Join Our Aggregation

We manage 1,980 MW+ of clean energy assets—giving system owners greater leverage, stronger pricing, and access to more market opportunities.